tax per mile rate

Instead a portion of the rate is applied equaling 26 cents-per-mile for 2021 down one cent from 2020. You can think of it as a pay-per-mile tax that subsidizes government programs.

There are two ways to calculate mileage reimbursement.

. Here is the detail about the mileage rates of some states in the United States. The standard mileage rate. Your employer reimburses mileage at a rate of 30 cents per mile.

So for the 2022 tax year you are able. Pennsylvania which has the highest fuel tax in the nation at 587 cents per gallon recently began discussions on whether or not an 81-cent-per-mile tax was appropriatethis. You can deduct the.

Business owners can now deduct 625 cents per mile through the rest of 2022 instead of 585 cents with the optional standard mileage deduction. June 18 2022. Every year the IRS determines a new standard mileage reimbursement rate for tax purposes.

For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. As an Amazon associate and affiliate for other products and services I earn from qualifying purchases.

625 cents per mile for business purposes. Carrying through the example above. 22 cents per mile for medical and moving purposes.

Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. This is the per-mile amount that a taxpayer can deduct from their taxes for each mile driven for business. Beginning on January 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

On June 9 2022 the IRS announced an increase in its mileage rates for the final six months of 2022. Here are the current rates for the most popular freight truck types. The standard mileage rate writes off a certain amount for every mile you drive for business purposes.

IRS Standard Mileage Rates from July 1 2022 to December 31 2022. The IRS has announced that the standard mileage. Youll be able to deduct 560.

Beginning July 1 2022 the standard mileage rate for business travel will. This can help small. Though the mileage rate changes based on inflation its important to.

These are for medical miles driven and miles driven during charity work. The standard mileage rate for business is based on an annual study of the. As of July 2021 trucking rates per mile remain steady.

The new rate for. The standard mileage rate for medical miles is 17 cents per mile driven and for charity work the mileage rate is 14. 585 cents per mile driven for business use up 25 cents.

For the first half of 2022 the rate is 585 cents per mile and increases to 625. Mileage tax is a type of tax that is paid by the driver based on miles driven. For example if you drove your vehicle 1000 miles for IRS-approved business purposes in 2021 multiply 1000 miles x 056 per mile.

IRS standard mileage rate. A standard mileage rate is the dollar amount per mile imposed by the Internal Revenue Service IRS when calculating the deductible costs for business use of automobiles. For tax year 2021 the Standard Mileage rate is 56 centsmile.

The standard mileage rate tax deduction is set by the IRS every year. Overall average van rates vary from 230 286 per mile. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate.

15 rows Find optional standard mileage rates to calculate the deductible cost of operating a. Multiply the standard mileage rate by your total miles driven or determine your actual expenses for the year. For journeys beginning on or after January 1 2022 the mile reimbursement rate is.

Rate reimbursed on Form 2106. What is a mileage tax. 575 cents per mile driven for business use down one.

Irs Raises Standard Mileage Rate For Final Half Of 2022

Irs Raises Standard Mileage Rate For 2022

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

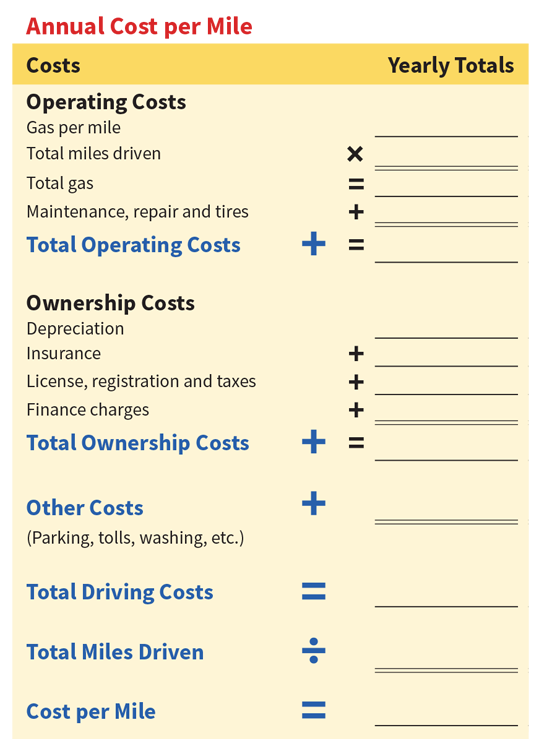

Aaa S Your Driving Costs Aaa Exchange

Aaa S Your Driving Costs Aaa Exchange

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Motor Fuel Taxes Urban Institute

The Irs Mileage Rate For 2020 See How Much You Can Get Per Mile

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

Issues And Options For A Tax On Vehicle Miles Traveled By Commercial Trucks Congressional Budget Office

Issues And Options For A Tax On Vehicle Miles Traveled By Commercial Trucks Congressional Budget Office